The gyrations around the disappointing ADP report suggest that the market may be in a “bad news is good news” regime. A lower-than-expected ADP report gave rise to thoughts that the Fed might not taper off after all, which helped to reverse the “risk off” mood that had predominated before the figures because of disappointing Eurozone data and thoughts that the ECB may not offer anything to support growth today. But the cautious mood resumed shortly afterwards anyway as US stocks fell and bond yields came down. Commodity currencies were particularly hit as commodity prices fell.

The market will focus today on the Bank of England and the ECB. No change in policy (and hence no statement) is expected from the Bank of England. Yesterday’s May service sector PMI was significantly better than expected, rising for the fifth consecutive month to the highest level in a year. If it weren’t for the arrival of Mr. Carney next month, people might start thinking about a rate rise in the UK.

As for the ECB, virtually no one expects a change in either the refi rate or the deposit rate. There have been mixed messages coming from board members, many of whom appear opposed to negative rates and yet willing to consider them, perhaps as an effort not to appear doctrinaire. The comments opposing purchases of asset-backed securities have also been more vocal than those arguing in favor. Again then the focus will be on the press conference afterwards to see how the debate is going. Last month EUR/USD rose a bit after the announcement of a cut in the refi rate by 25 bps but then went sharply lower during the press conference. No change this month could push EUR/USD lower, but I would expect Draghi once again to hint that further moves are possible as they “monitor very closely all incoming information.”

Later in the day the new Bank of Canda Governor, Stephen Poloz, testifies at the House of Commons Finance Committee. It will be his first public comment since becoming BoC Governor.

The Market

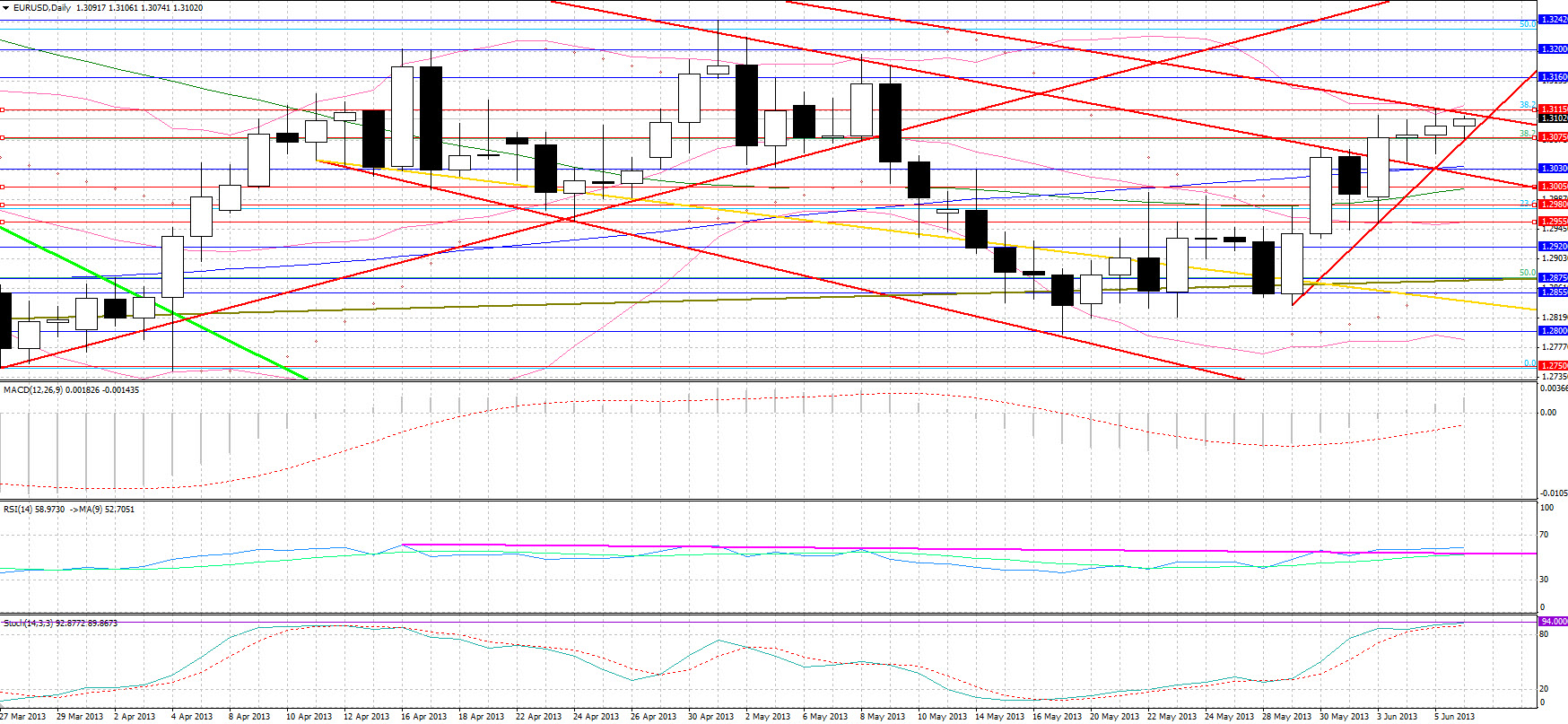

EUR/USD EUR/USD" title="EUR/USD" width="1748" height="807">

EUR/USD" title="EUR/USD" width="1748" height="807">

• EUR/USD moved lower during the European session as the Markit Services PMI, the retail sales and the revised Eurozone GDP figure came out slightly worse than expected. The pair rebounded however with the worse-than-expected ADP employment change figure, hitting resistance at 1.3115, the 38.2% retracement level of the February – March plunge. The pair shed two-thirds of those gains within four minutes, however, as the ADP figures the past year have been downward biased compared to the NFP figures, which are due tomorrow. The marginally better-than-anticipated ISM non-manufacturing PMI for the US was outweighed by the less-than forecasted, albeit improved, US factory orders, with the pair rebounding. 1.3075 is a key support level at the moment, with 1.3110 – 1.3115 being a first resistance area. Resistance thereafter comes higher at 1.3160 and 1.3200. Support below 1.3075 comes at 1.3030 and 1.3005, the 200- and 50-day MA respectively, with further support seen at 1.2980, 1.2955 and 1.2920, in a day when substantial volatility is likely in light of Draghi’s press conference following the ECB rate decision. The RSI is well and truly above its 8 week resistance trendline, but the Stochastic is at a common resistance level, although not at a record high.

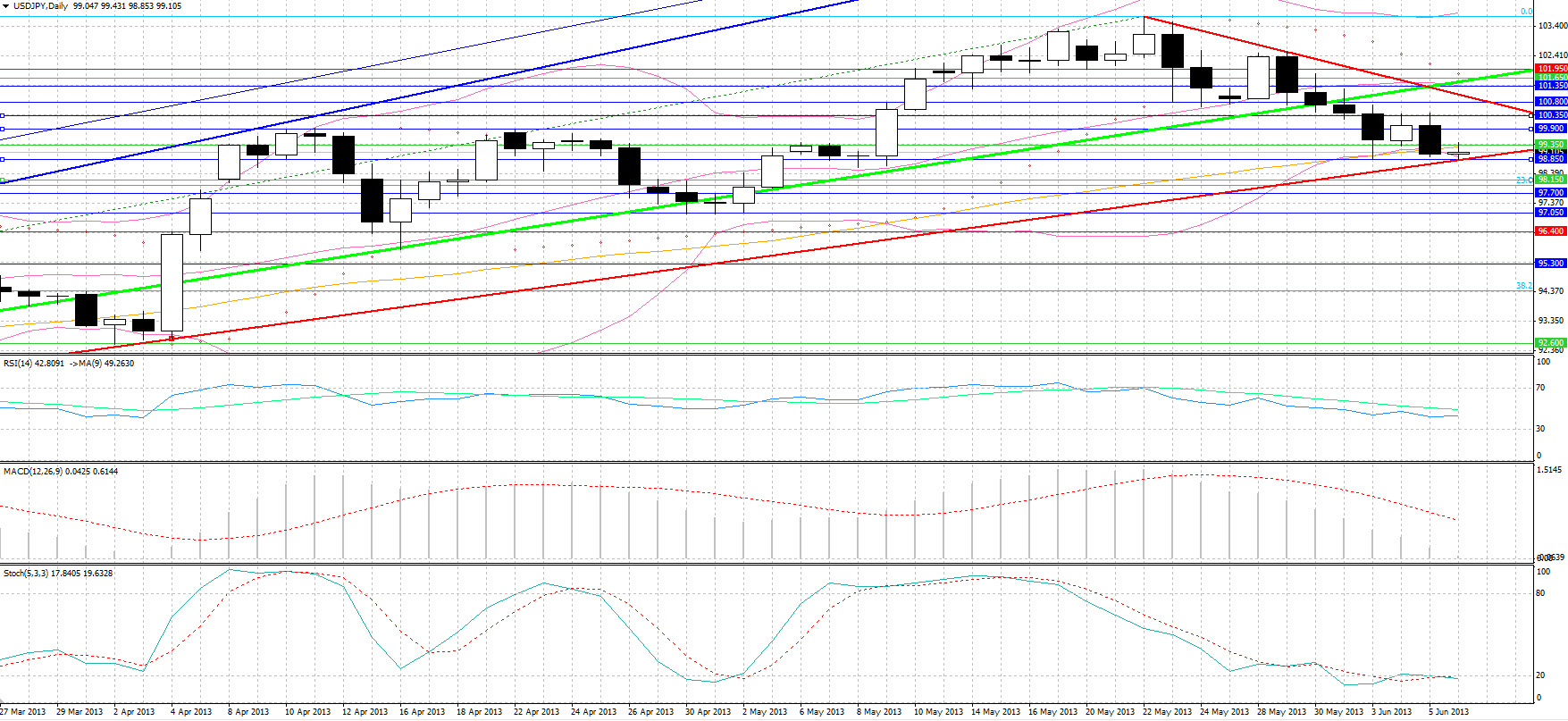

USD/JPY  USD/JPY" title="USD/JPY" width="1755" height="807">

USD/JPY" title="USD/JPY" width="1755" height="807">

• USD/JPY declined throughout the day as the US released a stream of dollar-negative data. Lower Bollinger and spike trendline support came at 98.85, but resistance came early at 99.40. Support for the day looks to come in the 98.85 – 99.00 area with further support at 98.15. Resistance above 99.35 is seen typically just below the 100-mark, around 99.90.

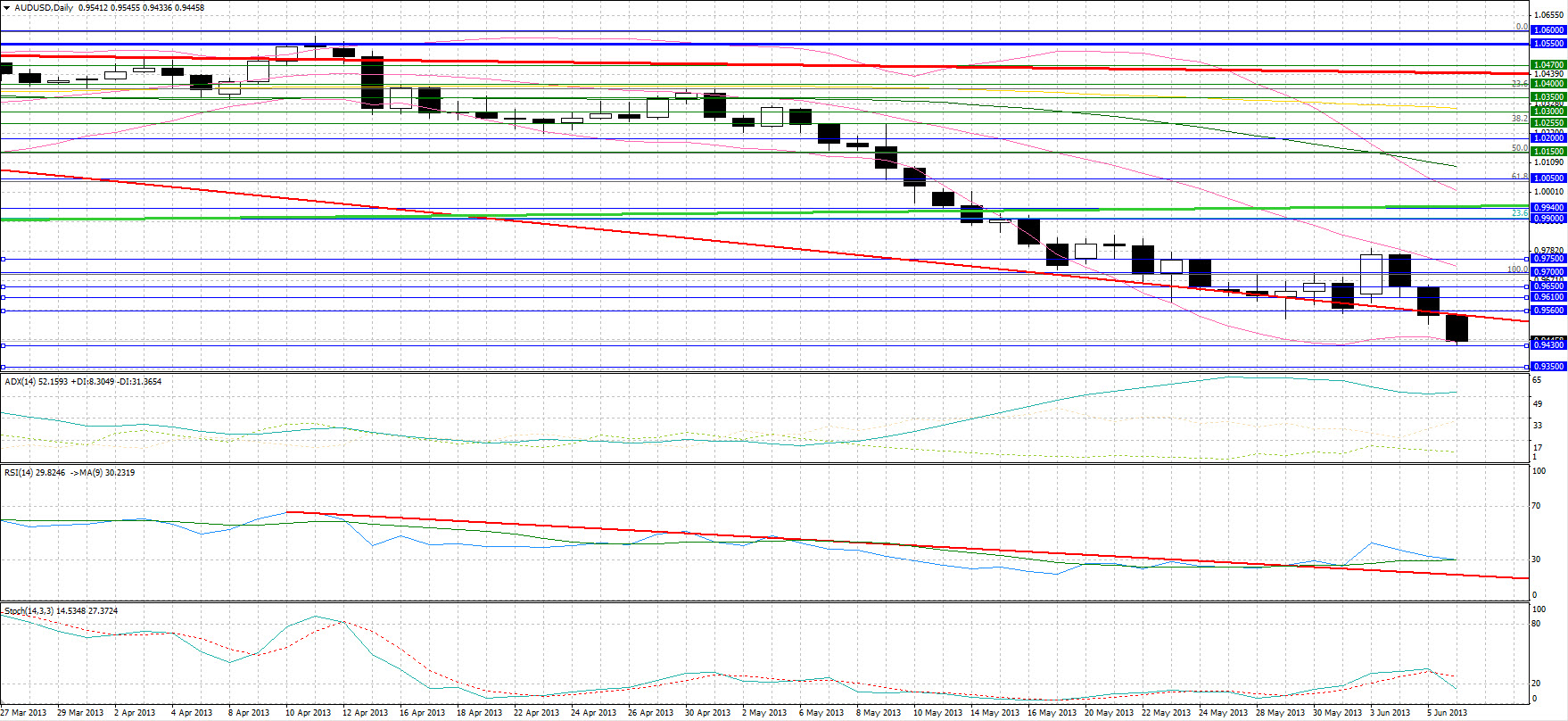

AUD/USD  AUD/USD" title="AUD/USD" width="1758" height="808">

AUD/USD" title="AUD/USD" width="1758" height="808">

• AUD/USD was a major loser yet again as Australia’s trade surplus decreased by 95%, greatly missing expectations, with exports falling, partly due to a slowdown in China’s economic growth. Support came at 0.9430, with support thereafter seen substantially lower at 0.9350. Resistance comes at the well-tested levels of 0.9560 and 0.9610.

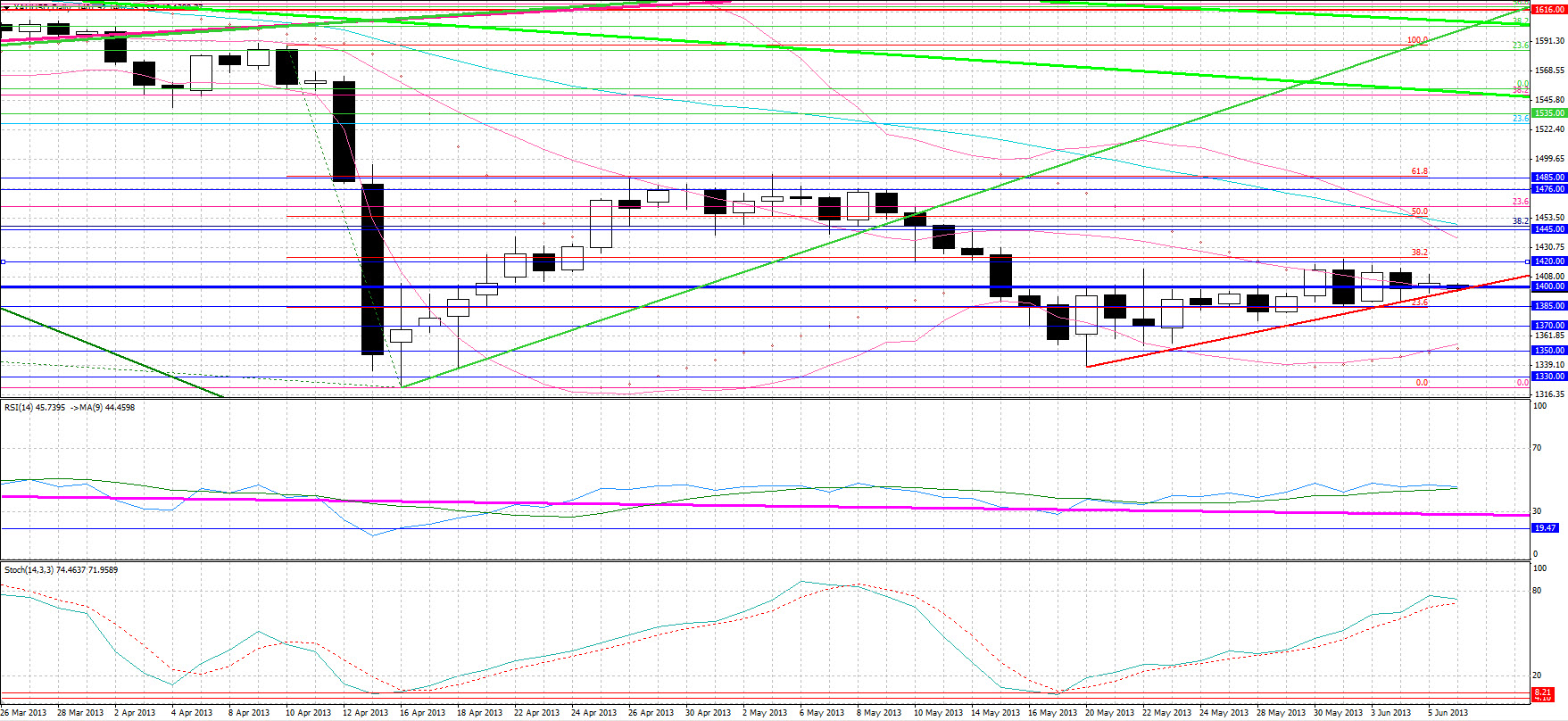

Gold

• Gold rebounded from $1395 support on the announcement of the poor US economic data, but yet again failed to test resistance, with resistance actually coming lower. $1400 is the clear support level for the day with a break possibly leading to a small breakdown from the upward-sloping trendline. The almost overbought Stochastics and the fact that a possible decline today will coincide with simultaneous bearish RSI and Stochastics crossovers is something that must be taken note of. Support below $1400 is likely to come at $1385, with further support at $1370. Resistance comes at $1420 and $1445, although yesterday’s high was at only $1410.

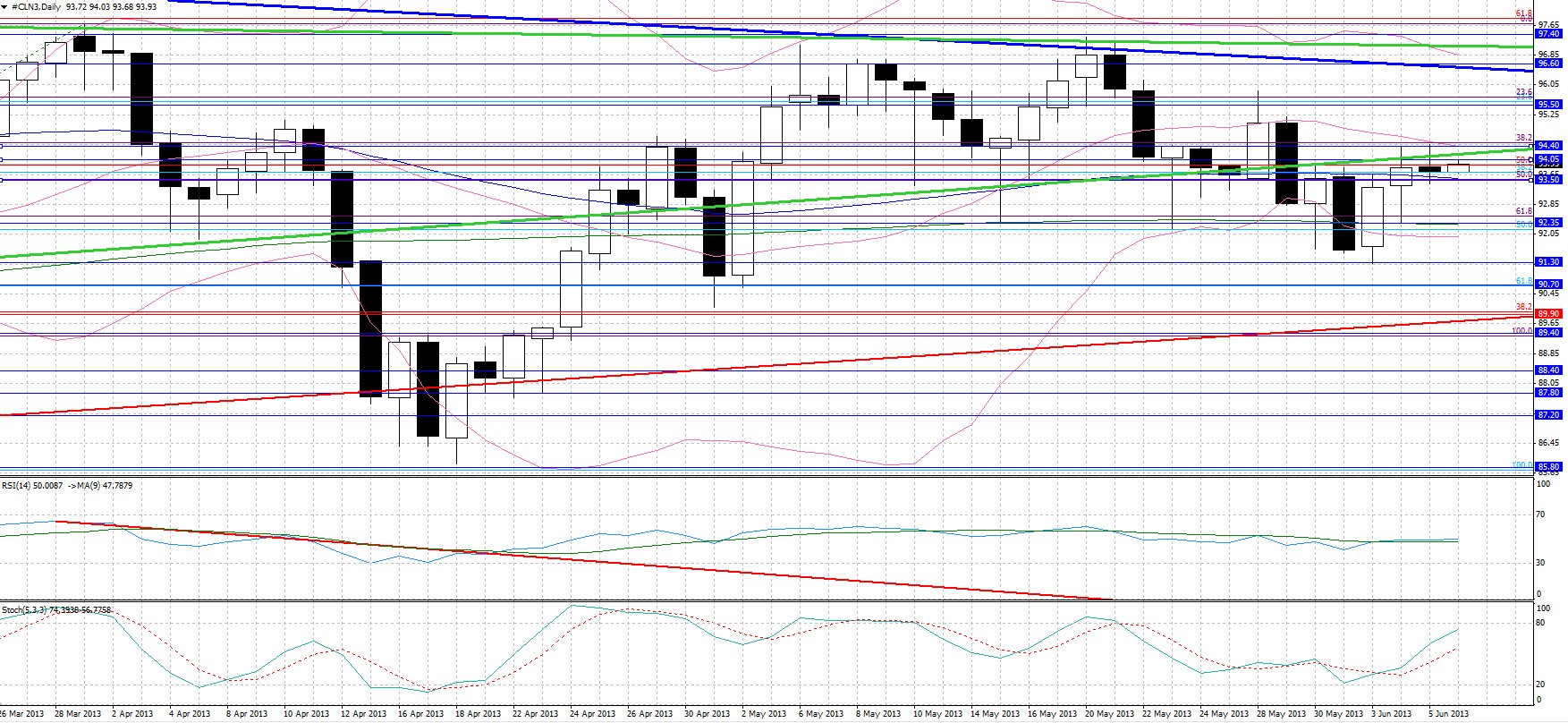

Oil

• WTI acted yet again more as a dollar-denominated asset than as a crucial commodity for the economy, gaining on the release of weak US data as the dollar depreciated. Crude shed those gains soon after however, before spiking to $94.45 resistance on the release of the largest decrease in inventories in 9 months. Support is seen at $93.50, which sees the 50-day MA and a well-tested Fibonacci level, with further support at the 200-day MA at $92.35. Resistance is likely to be seen again at $94.05 and $94.40, with further resistance at $95.50.

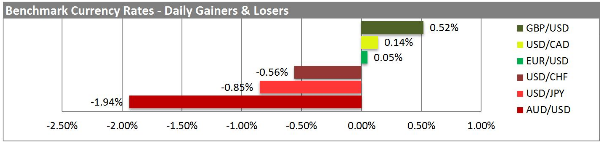

BENCHMARK CURRENCY RATES - DAILY GAINERS AND LOSERS

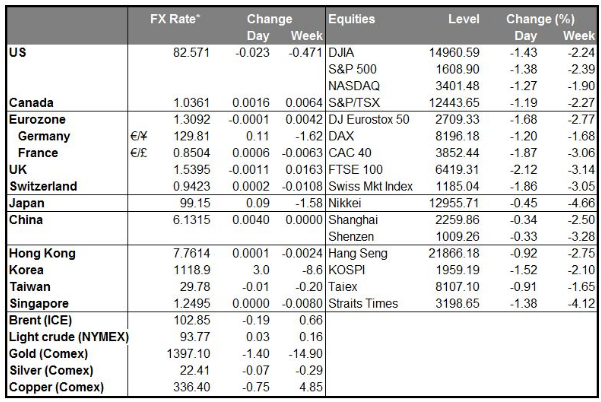

MARKETS SUMMARY

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bad News Is Good News? ADP Report Reversing The "Risk-Off" Mood

Published 06/06/2013, 07:15 AM

Updated 07/09/2023, 06:31 AM

Bad News Is Good News? ADP Report Reversing The "Risk-Off" Mood

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.